The impact of the U.S. twin deficits on the world economy

[New Management Knowledge]

"Twin deficit" means that a country has a "fiscal deficit" and a "current account deficit" (or foreign trade deficit) at the same time. Fiscal deficit refers to the situation where government revenue and expenditure exceeds the expenditure. The current account deficit refers to the portion of foreign trade in which imports exceed exports (foreign trade deficit) plus the net expenditure of "current account transfers". In addition to the foreign trade of commodities, the import and export here also include the income and expenditure of international capital and labor (such as interest income/ expenditures from external borrowings, income/ expenditures from profits from foreign investments, and remittances from nationals working abroad. foreign exchange or foreign exchange remitted by foreigners working in the country, etc.). Current account transfer refers to the net amount of gifts from the country's government or private sector that do not have to be returned to foreign countries, such as foreign aid and charitable donations. The amount is usually very small, but because the net amount in the United States is negative, it represents "net expenditure", plus The foreign trade deficit is even worse.

In the past four decades, except for a few years when the United States had fiscal surpluses or foreign trade surpluses, it ran deficits during most of the period. Since the United States is the world's economic superpower, its gross domestic product (Gross Domestic Product-GDP) accounts for 30% of the world's total, playing an important role in the world economy. The problem of twin deficits has intensified since Bush took office, attracting international attention. This article intends to explore the "twin deficit" phenomenon in the United States in recent years and speculate on its possible long-term impact on the world economy.

twin deficit trend

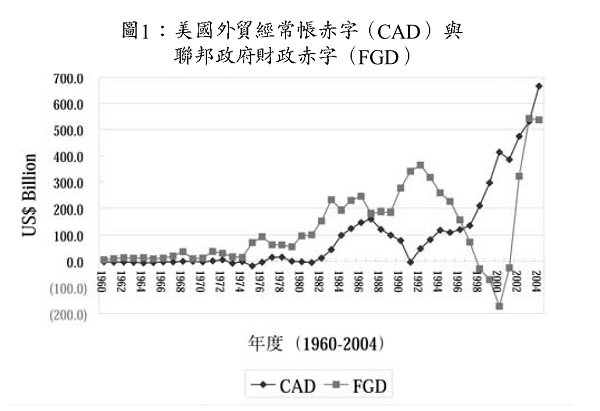

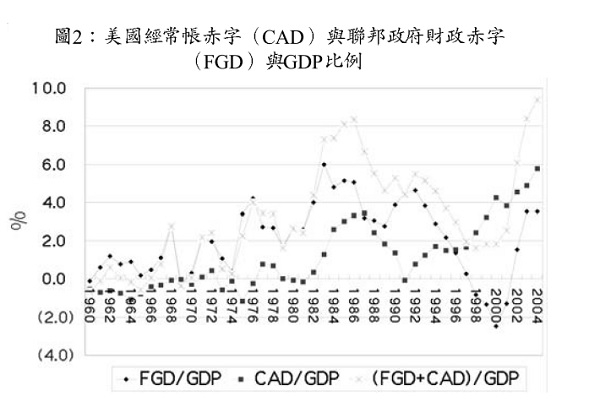

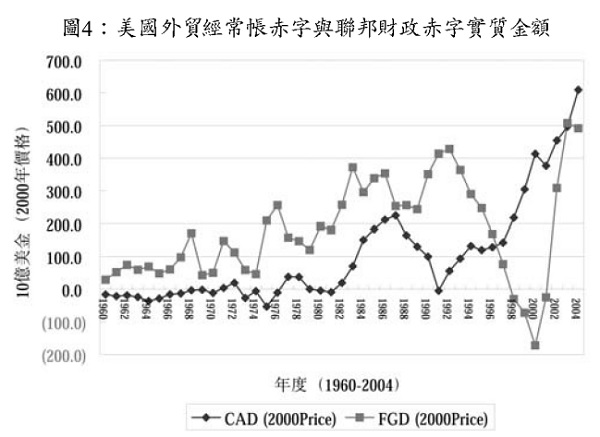

Figure 1 shows the amount of the U.S. foreign trade current account deficit and the federal government fiscal deficit during the period from 1960 to 2004. Usually we use the ratio of GDP to observe the long-term trend of the two and their sum (see Figure 2).

fiscal deficit

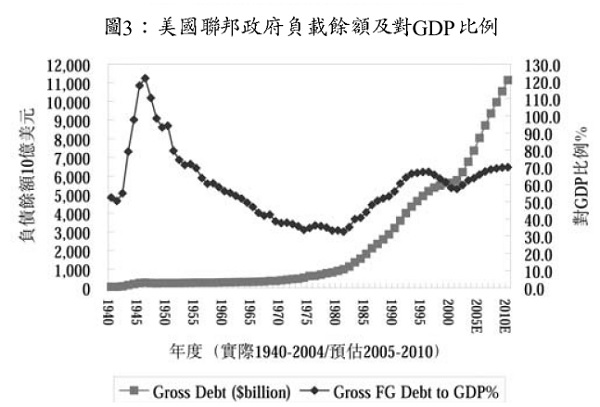

As shown in Figures 1 and 2, over the past four decades, the federal budget of the United States has been in deficit in most years (the total fiscal budget of local governments is very small compared to the federal government, so it will not be discussed here). In 2003 and 2004, the federal deficit accounted for about 3.5% of GDP. The average deficit of high-income advanced countries similar to the United States was 2% of GDP. It can be seen that the United States is slightly higher. The total government debt balance has also been increasing. Figure 3 shows the long-term trend from 1940 to 2010, where 1940 to 2004 is the actual amount, and 2005 to 2010 is the estimated amount by the U.S. Budget Office.

In the 1930s, President Roosevelt (1933∼45) implemented the New Deal with fiscal deficits to restore economic vitality from the Great Depression of the 1930s, and then entered World War II in the 1940s. After the war, it helped other countries rebuild in the 1950s, and was involved in the Vietnam War from 1950 to 1975. After the war, President Johnson (1963∼69) declared the ideal of the "Great Society" and greatly increased social welfare, resulting in federal debt increasing year by year. However, due to the economic improvement and rapid growth, the ratio of total federal debt to GDP has decreased year by year from the peak of 121% in 1946 to 32% in 1981 after Reagan (1981∼89) came to power. The federal deficit rose sharply to $70.9 billion in 1975 when President Ford (1974-77) was in office.

After Reagan came to power, he implemented tax cuts and eliminated various controls. The annual deficit began to exceed 100 billion, and the debt balance increased from nearly 1 trillion US dollars in his first year in office to 2.6 trillion US dollars before he stepped down in 1988. The fiscal deficit for that year is 188.5 billion. However, Reagan's tax cut policy was also accompanied by a significant reduction in government spending, otherwise the deficit would be even larger. The elder Bush (1989∼93) launched the Iraq War during his tenure. When he resigned, the balance of debt handed over to Clinton had reached 4 trillion, and the annual deficit was as high as 363.3 billion. Although the ratio to GDP was not a historical peak, it also attracted the attention of all parties. ; Because the more government debt there is, the borrowing interest rate will increase, squeezing private loan supply and demand and housing loan pressure, and also affecting the investment costs of enterprises.

When Clinton (1993∼2001) took office, he followed the advice of Federal Reserve Board Chairman Greenspan and worked to eliminate the fiscal deficit left by the Republican administration, which he did. On the one hand, during his eight-year term, the U.S. economy began to grow significantly and rapidly, and government tax revenue also increased year by year (the proportion of total fiscal revenue in GDP increased from 17.5% in 1992 to 20.9% in 2000). He also reduced government spending as much as possible (the ratio of total spending to GDP dropped from 22.1% to 18.4% during the same period). As a result, before Clinton stepped down in 2000, not only did the government's fiscal deficit disappear, but there was still a surplus of 172.1 billion that year ( Accounting for 2.5% of GDP). During his eight years in office, the balance of government debt only increased to 5.6 trillion, and the ratio to GDP dropped from 66% when Bush was in office to 58%. To be fair, in terms of economic performance, Clinton may be the best-performing president of the United States in the past half century: inflation is very low, interest rates have been significantly reduced, economic growth is at a record high, and there is a fiscal surplus, but The current account deficit has not improved.

In the first year of Bush's administration (2001), relying on the capital left by Clinton, there was still a small fiscal surplus of 25.3 billion. However, not long after he took office, the United States began to fall into a depression period in the economic cycle, and economic growth slowed down. In order to revitalize the economy, he adopted a policy of substantial tax cuts, hoping that through tax cuts, people would spend their extra money. As consumption increases, companies will increase production. At the same time, the number of employed people will increase. Workers will have income (or unemployment will decrease) and will continue to consume. In this virtuous cycle, the economy will grow and tax revenue will increase, making up for the loss of the government's tax cuts.

But this policy may not necessarily be effective. The September 11 attacks in 2001 occurred shortly after George W. Bush took office. In order to stop and retaliate against terrorist attacks, the George W. Bush administration launched a war in Afghanistan, consuming a large amount of U.S. resources. After the war in Afghanistan, he was still busy rebuilding Afghanistan and promoting democratic politics. On March 20, 2003, Bush launched the second war in Iraq. The United States suffered heavy casualties in this war and consumed many times more resources than the war in Afghanistan. It is still unable to escape. Tax cuts, military spending and social welfare expenditures have not increased government revenue due to the economic recession, causing the fiscal deficit to increase rapidly year by year. In just four years after George W. Bush took office, the federal budget turned from a profit to a deficit, reaching a record high of US$540 billion in both years from 2003 to 2004. Fortunately, in terms of GDP ratio, it only reached 3.5%, which is not yet history. New high, but the follow-up is unpredictable.

The Congressional Budget Office, an independent administrative body, estimates that two-thirds of the fiscal deficit in 2004 was due to tax cuts. Under the existing large fiscal deficit, George W. Bush "intensified" and passed the "American Job Creations Act of 2004" (American Job Creations Act of 2004) through the Republican-majority House and Senate in October 2004. A total of 145 billion yuan in tax cuts will be provided to enterprises and farmers, with the purpose of stimulating production and increasing employment.

Scholars and many members of Congress are not optimistic about the move. On the one hand, the Iraq War is not over yet, and on the other hand, the manufacturing industry in the United States has gradually moved to areas with low production costs over the years. The proportion of manufacturing in GDP and the proportion of manufacturing employment in total employment increased from the mid-1960s to 2003. It has been declining year by year, from 27%/24% to 13.8%/10.5% respectively. Trying to use tax cuts to increase employment has dubious results. Moreover, in the United States in recent decades, due to technological advancement, the productivity of manufacturing workers has continued to increase, reducing the need for new jobs and limiting employment growth. Furthermore, the gap between rich and poor is growing in the United States (as in other countries). The U.S. Census Bureau reported in August 2004 that the number of poor people in the United States increased by 1.3 million in 2003, and the number of people without health insurance increased by 1.4 million; these are potential social problems.

During George W. Bush's tenure, in addition to military spending, other fiscal expenditures were also unrestrained. Even David Walker, the Comptroller of the Treasury Department, believed that the biggest threat to the future of the United States was fiscal irresponsibility. The recent hurricanes Katrina and Lita swept through New Orleans and the Texas coast, causing huge damage, and soaring oil prices have made the situation even more serious. In fact, among the current fiscal expenditures, social security (i.e., national pension) expenditures are the largest, accounting for 4.3% of GDP in 2004, followed by the national defense budget, accounting for 4.0%; health and elderly medical insurance also totaled 4.4%. International comparison of military expenditures shows that the United States spent 417.4 billion U.S. dollars in 2003, accounting for 47% of the world's military expenditures. The average expenditure per American was 1,419 yuan, which was only slightly lower than Israel's 1,551 yuan. Unless all major countries in the world can turn their weapons into sickles and reduce military expenditures, everyone will be engaged in an arms race and world peace will be out of reach!

current account deficit

In addition to the fiscal deficit issue, the U.S. current account's huge deficit for consecutive years is also a major concern; in 2004, the combined amount of the two and the proportion of GDP in 2004 was 9.4%, which was also a record high. Calculated at constant 2000 prices, the ratio of the twin deficits to GDP during George W. Bush’s term also reached a record high between 2003 and 2004 (see Figure 4).

The opposite side of the current account is the capital account of the inflow and outflow of foreign capital. A current account deficit means there is a net inflow of foreign capital, that is, borrowing money from abroad. The U.S. current account deficit reached a historical peak of RMB 160.7 billion in 1987 during the Reagan era, accounting for 3.5% of GDP. It has since declined in successive years, and in 1991 under Bush Sr., it still generated a surplus of RMB 3.7 billion. During Clinton's tenure, the current account deficit began to climb, from $48 billion (0.8% of GDP) in 1992 to $413 billion (4.3%) in 2000. During George W. Bush's term, the economy has reached new heights. In 2004, it reached a new historical peak of 665.9 billion (5.8%). A few years ago, the United States was a net creditor country to foreign countries, and then it began to become a net debtor country. In 2004, the total foreign debt of the United States reached 30% of GDP and is still increasing rapidly.

The main reason for the current account deficit is the large amount of imported cheap and high-quality goods, but part of it also reflects the foreign investment of American multinational companies over the years, about half of which are in Europe and the rest are scattered in developing countries; in addition to domestic sales in landlords, there are also a large number of Some goods are sold back to the United States, forming part of the foreign trade deficit. Foreign investment is also one of the main reasons why the proportion of U.S. manufacturing in GDP and manufacturing employment opportunities have been declining. U.S. manufacturing production provided 90% of total domestic consumption in the mid-1990s, but this ratio has dropped to 75% in just ten years. This situation has become more common since the 1990s. Due to low wages in developing countries, many companies in the United States and other high-income countries (including Taiwan) have moved production abroad. Especially since the 1990s, mainland China has become the world's manufacturing factory.

In December 2004, the US "Business Week" reported that the rise of China's economy has affected almost every American industry because the price of Chinese exports is too low, often lower than the cost of materials required for domestic manufacturing in the United States. Still low, the U.S. manufacturing industry cannot compete with China, and many manufacturers have been forced to set up factories in China or other low-wage countries. Moreover, China manufactures not only traditional goods such as textiles, but also high-tech products. However, when multinational companies produce abroad, they still have to pay profit taxes to the United States. Americans abroad also have to pay income tax to the U.S. government. Together with repatriated wages, this partially offsets the foreign trade deficit.

Make up for fiscal deficit and current account deficit

The twin deficits mean that the United States, a superpower, imports more than it exports, and relies on foreign funds to help with the shortfall; the fiscal deficit is covered by the issuance of U.S. long- and short-term public bonds. In addition to purchases by domestic investors and banks, a large part of public bonds are held by foreign central banks and become part of their foreign exchange, especially in East Asian countries; for example, the majority of the 800 billion foreign exchange in mainland China and the 250 billion foreign exchange held by the Central Bank of Taiwan It is kept by holding U.S. government bonds, because in international finance, the U.S. dollar is regarded as a zero-risk financial instrument. Foreigners currently own 50% of U.S. Treasury bonds, 12% of government agency bonds, and 25% of corporate bonds. The fiscal deficit also means that part of the private (private and corporate) savings are indirectly used to offset the fiscal deficit, so that private investment is squeezed and needs to be maintained by the investment of foreign funds (which is also reflected in the expansion of the current account deficit).

Since the 1990s, global inflation has been under control, keeping interest rates relatively low. Even if the Federal Reserve continues to raise interest rates in the past year, the fiscal deficit is not yet in crisis, and low interest rates can still be used to raise funds to deal with it. But if the U.S. fiscal deficit continues to increase, the government must raise public debt rates to attract foreign investors. At that time, domestic interest rates will be forced to increase, which will increase the borrowing costs of producers or investors and slow economic growth even further, creating a vicious cycle. In addition, if the current account deficit continues to expand, once foreign countries lack confidence in the U.S. economy and their central banks withdraw U.S. dollars or stop purchasing U.S. government bonds, the U.S. government may go bankrupt and the U.S. dollar will depreciate sharply; a small depreciation will help Increased exports, but a sharp depreciation may cause a financial crisis and stock market crash, just like the Great Depression of the 1930s, with unimaginable impact on the global economy.

In the short term, because the U.S. economy is still growing, the ratio of the twin deficits to GDP is currently within a tolerable range; but in the long term, both phenomena are harmful to the future development and growth of the U.S. economy. Former US Federal Reserve Chairman Paul Volker believes that there is a 75% probability that the US will experience a financial crisis within five years. Nobel laureate in economics Joseph Stiglitz and many scholars also believe that the situation is serious.

What the twin deficits in the United States inspire Christians

For Christians, it is recommended to pray more for America’s political leaders and ask God to give them wisdom in handling economic affairs. Personally, it is recommended to pay more attention to family finance and investment. Except for investment loans (such as housing loans and car loans necessary for work), it is not advisable to have debts, especially credit card debts that are like loan sharks.

We should pay more attention to the future trend of the US twin deficits. The author hopes that the Bush administration will pay attention to fiscal discipline, stop giving more tax cuts to the rich, reduce government spending, and reduce the federal deficit as soon as possible. The foreign trade deficit is a more difficult problem to solve. If the United States can maintain its leading position in the service industry and the research and development of cutting-edge high-tech software and hardware products to maintain competitiveness and increase exports, the foreign trade deficit can be gradually reduced.

If this superpower's twin deficits continue to expand, and it has been living a life of struggling to make ends meet, and the gap between the rich and the poor in the country has widened, coupled with the global natural disasters caused by the greenhouse effect every year, man-made disasters caused by terrorists, and the soaring global oil prices , the raging bird flu virus, etc., which discouraged foreign investment in the United States, leading to a financial crisis in the United States, followed by economic contraction, and a domino effect that caused a world economic crisis. The consequences will be very serious.

(Note: The sources of statistics and figures cited in this article are all from data published by the US government on its website, including the databases of the US Department of Commerce, Office of the Budget, Federal Reserve Board and the International Monetary Fund.)

Author profile

Author profile

Wen Yingqian is currently a professor at the Department of Economics at National Dong Hwa University in Hualien, Taiwan. He holds the Chartered Financial Analyst qualification from the United States and has served as an economic expert at the World Bank for more than 20 years. PhD in political economics from Johns Hopkins University, USA.