The national debt and fiscal deficit crisis

Preface

The financial crisis that started in the United States in 2008 swept across the world, and almost all countries suffered - economic depression, rising unemployment, falling prices of financial assets and real assets (such as real estate), and a subsequent decline in living standards. As of 2010, although the global economy has recovered, the pace is still slow.

One of the causes of the financial crisis is excessive consumption and debt by governments and people of various countries. The United States is a global economic power and has taken the lead. The government and people of the United States have been experiencing excessive consumption and debt for many years. In particular, the government, from the federal to the local governments, has been borrowing money to get by. The long-term consequences are worrying, because it will lead to a situation where "the debts of the father and the children cannot be repaid", especially now that high-income countries, including Taiwan, have entered an age of aging. In addition to paying taxes, Many elderly people still have to bear the debts of the previous generation (through social security funds and pension mechanisms). 11

This article intends to discuss the issue of national debt and fiscal deficit, and combines biblical principles to point out that the way to maintain a strong and prosperous country and sound personal finances, and therefore receive blessings from God, is to control long-term personal and government borrowing. This article will mainly discuss the United States, followed by other related countries.

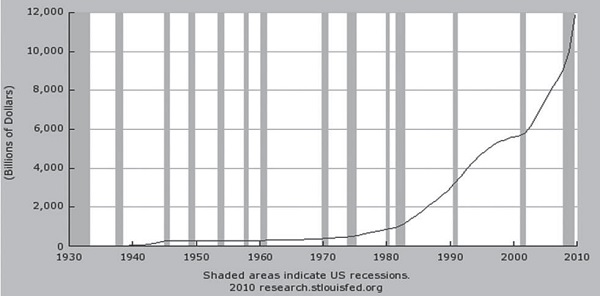

Figure 1: Trend chart of U.S. federal debt (1939-2010, unit: million U.S. dollars)

(Source: http://research.stlouisfed.org/fred2/series/FYGFD)

America's debt problem

美國發生金融危機的遠因之一就是過度的消費與負債。2 美國政府預算赤字近年來一直破紀錄,貿易也呈現大幅赤字,就是所謂的「雙赤字」。3聯邦政府的預算赤字在2008年10月(財政年度開始)達美金4,550億,高於2004年破紀錄的4,130億;而2009年財年赤字達1.4兆(萬億trillion)。2008~2009財年的赤字主要是因應金融危機而行的紓困計畫。

美國聯邦政府赤字增加代表國債(national debt或稱主權債務)的增加。國債指聯邦政府所發行的公債餘額(未償還總額debt outstanding)。由於金融危機,國債到2010年6月已達13.2兆美元(見圖1)。4 為了警惕美國政府和人民,民間機構還設置一個國債鐘,每天顯示國債總數;網站也登出每人負債額,例如2010年7月,每人平均要負擔42,000元的國債,而國債還以每天40億美元的速度增加中。5

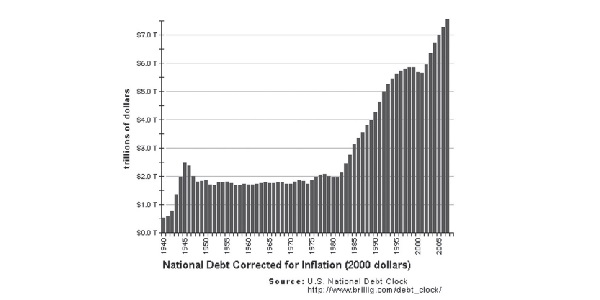

Before 1983, the real national debt after deducting inflation factors had been stable except for an increase during World War II. But it soared sharply after 1983. Only in 2000 and 2001, when President Clinton left office, the federal budget ran a surplus for the first time in a long time, so the national debt fell slightly. It has been rising at other times (see Figure 2). In response to the rise in national debt, the U.S. Senate passed a new debt limit increase of 1.9 trillion U.S. dollars on January 28, 2010, to 14.3 trillion U.S. dollars, which is equivalent to the U.S.'s annual gross national income (GNP). The debt amount per person is 45,000 yuan.

Figure 2: Trend of U.S. federal government debt after deducting inflation (1940-2010, unit: trillion U.S. dollars)

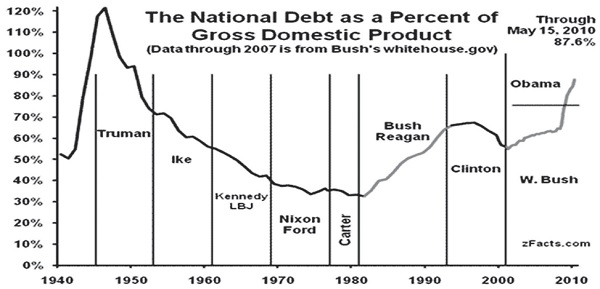

The ratio of the U.S. national debt to gross domestic product (GDP) was the highest before World War II, exceeding 100%. After the post-war period, the ratio declined year by year, reaching the lowest point of about 35% when President Carter was in office in the late 1970s. It started to climb after that and is now close to 90% (see Figure 3). According to the federal deficit reduction plan, the ratio is expected to peak at 101% in 2011 and then start to decline slightly. The proportion of national debt owned by foreigners has increased from nearly 30% in the 1970s to 40% currently. The countries with the largest national debt are China and Japan. 66

Figure 3: Ratio of U.S. national debt to GDP (1940-2010, %)

(Source: http://zfacts.com/p/318.html)

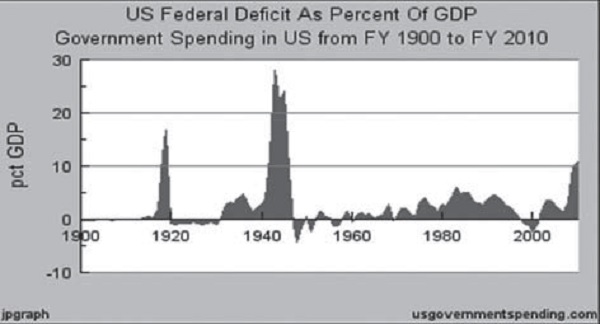

Closely tied to the national debt is the budget deficit. After World War II and until the 1970s, federal finances were relatively stable. The deficit as a proportion of GDP began to increase in the 1980s. In addition to the surplus at the end of Clinton's administration, the amount of deficit also increased significantly. Especially in the early days of President George W. Bush's administration, he used tax cuts to revitalize the economy and ate up most of the surplus accumulated during the Clinton period. Subsequently, he launched two War (Afghanistan and Iraq) caused the deficit to soar past historical records (see Figure 4). Before George W. Bush left office and after President Obama took office, he used massive borrowing to bail out and revive the financial crisis, causing the fiscal deficit to rise even more sharply in 2009 and subsequent years (from 3.2% in 2008). % increased to 9.9% in 2009 and 10.6% in 2010).

Fortunately, the U.S. state constitutions, with the exception of Vermont, prohibit state and local governments from running budget deficits. However, in recent years, many states have experienced austerity spending (such as California), and the financial difficulties cannot be ignored.

The country is like this, and American households also have high debt and low savings. The ratio of household debt service to household disposable income (after paying taxes) was as high as 14% before the financial crisis. That is, for every 100 yuan of income that a family has at its discretion, on average, 14 yuan is spent on debt repayment. For every 100 yuan of income, the average savings is less than 5 yuan (the savings rate is 5%, and in Asian countries it is as high as 20-30%). After the financial crisis, household debt service ratios have trended downward, while savings rates have also increased slightly, indicating that many Americans have noticed the problem of spending too much. But families borrowing money to survive become a potential problem for social security.

Figure 4: Ratio of U.S. federal fiscal deficit to GDP (1901-2010, %)

(Source: http://www.usgovernmentspending.com/federal_deficit_chart.html)

Global government debt problem

Fiscal deficits and government debt have existed since ancient times. "The government budget should be balanced; the treasury should always be filled; the public debt should be reduced; the arrogance of government officials should be controlled." The person who said this was a famous orator and politician of the Roman Republic at the same time as Julius Caesar. Marcus Tullius Cicero (106-43 BC). This sentence is still timeless and fresh. In history, many countries suffered a decline in national fortunes because of too much debt. At the end of the Warring States Period in China's Eastern Zhou Dynasty, King Nan of Zhou (in 256 BC) borrowed money from wealthy merchants and landlords to send troops to conquer the Qin State. As a result, he had no money to repay and was forced to hide on a high platform to avoid being collected by his creditors. This story has become a commonly used idiom "high debt".

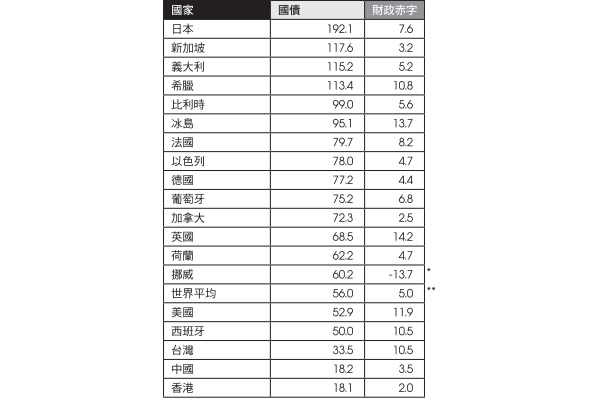

After the financial crisis, the seriousness of the debt and budget deficit problems of governments around the world has become more prominent. Taking 2009 as an example, the world average ratio of national debt to GDP was about 56%, while the ratio in many countries was higher than 100%. The vast majority of countries have budget deficits, and many of them have a deficit-to-GDP ratio of more than 10%, compared with the world average of about 5%, indicating a general lack of fiscal discipline among governments (see Table 1).

The financial crisis swept across Europe, and many governments in the euro area faced debt crises. The European Central Bank and the International Monetary Fund (IMF) jointly injected 750 billion euros to assist the "PIIGS" (PIIGS, Portugal, Ireland, Italy, Greece, Spain), which are "ridden with high debts". However, the European debt crisis has not yet been resolved, and the exchange rate of the euro against the US dollar has also fallen sharply. If the economies of major European countries fail to recover as soon as possible, the euro zone may decline again and spread to the world. This will also be extremely detrimental to Asian economies that are highly dependent on exports, such as China, Japan, and Taiwan. 77

Table 1: National debt and central government fiscal deficit (selected countries) (2009, ratio as % of GDP)

Source: CIA World Fact

*Estimated fiscal surplus**Sampling estimates

工業國家當然知道負債太多的危險,除了積極提倡金融改革,減少金融危機的再發,也積極向消減赤字方向前進。8 有些經濟專家建議,政府減少開支反而能促進經濟成長,因為政府債務減少,有助利率下降,因而使投資能增加。9

The communique of the summit held by the Group of 20 (G20) in Toronto, Canada on June 27, 2010 set the goal of halving the fiscal deficit of developed countries by 2013 and reducing the debt-to-GDP ratio by 2016, declaring that industrial countries will Towards a new era of austerity and deficit reduction. Countries in Eastern Europe, which are close to the European industrial countries, are also cutting back on spending and even reducing pensions for public servants.

很多人擔心,赤字的消減會減緩經濟成長及復甦的腳步。但一直採用赤字來振興經濟,是否有如飲鴆止渴,長期反而不利?舉辦G20峰會的主人,加拿大首相哈帕申明,他們要送出一個清楚的信息,一旦紓困刺激計畫結束之後,就要開始專注在財政上。G20國家也希望面臨赤字的先進國家提高儲蓄率,而享有貿易順差的國家則應逐漸轉型增加內銷,以導正貿易失衡現象(特別針對中國而言)。美國總統歐巴馬公開宣示,美國不能繼續用負債方式大量進口消費,美國要儘量提升競爭力出口。10 筆者認為以上這些減少負債及赤字的措施都是屬於正面的發展,有助於經濟的長期穩定。

What does the Bible say about debt?

The Bible views debtors as slaves. "The rich rule over the poor, but the debtor is the servant of his lender." (Proverbs 22:7) Not only individuals, but also nations are better off not being in debt. When Moses led the Israelites out of Egypt, God told the Israelites very clearly: “If you listen carefully to the voice of the Lord your God and obey all his commandments that I command you today, he will make you excel. above all the peoples of the world. If you obey the voice of the LORD your God, these blessings will follow you and come to you: ...the LORD will open a storehouse in heaven for you, and he will give rain to your land in due season. I will bless you in everything you do; you will lend to many nations, but you will not lend to them.” (Deuteronomy 28:1-2, 12)

If God obeys His word and obeys all His commandments, the nation of Israel will be blessed and will not be in debt to the Gentiles. God’s words also apply to advanced European and American countries influenced by Christianity. Looking at today's situation, the United States and Europe were originally advanced countries blessed by God, but after World War II, they began to drift away from God. Starting from Europe, the number of born-again and saved Christians gradually decreased, and Europe has become a gospel desert.

美國也是如此,在1948年最高法院判決「政教分離」原則以來,法院判決漸漸向世俗傾斜。例如學校及政府機關禁止公禱,法院及學校不准懸掛十誡,有法官裁決每年5月第一個週四的全國禱告日(National Day of Prayer)違憲,11向鼓吹同性戀權益及合法墮胎的政策低頭等等。結果美國成了犯罪日益猖獗,學校道德日益敗壞的國家。從統計數字觀察,美國在1970年代就由全世界的最大淨債權國家,在1985年開始轉變成為淨負債的國家,並且在2004年開始成為最大的債務國。12 是否真的應驗了聖經的話語,如果不聽從神的話語,則:「在你中間寄居的,必漸漸上升,比你高而又高;你必漸漸下降,低而又低。他必借給你,你卻不能借給他;他必作首,你必作尾。」(申命記28:15、43-44)歐美列強是否因為不聽從神的話,開始有禍患?

CONCLUSION

The Bible does not say we cannot borrow money, but the Bible does not encourage us to go into long-term debt. The country does not want to be in debt for a long time. It is a pity that the governments of almost all democratic countries do not follow God's teachings very much. In line with Cicero's words, arrogant officials and national leaders have always been relatively indifferent to the expenditure of people's wealth and support. Especially the heads of democratically elected governments, most of them are very happy with their achievements when they are in office. , likes to borrow money for construction, and the successor will clean up the aftermath anyway. Therefore, if the government of a democratic country does not have fiscal discipline, the government debt will increase. What is ridiculous is that many governments have been proposing debt ceilings to Congress (this is the case in the United States and Taiwan) so that the government can increase the amount of debt in accordance with the law. However, all consequences are the responsibility of future generations, and government officials cannot control them.

What can Christians do? We should pray hard that the people in the United States and the advanced countries in Europe that were once blessed by God can return to God and not stray away from God to avoid being cursed (because they did not keep God’s commandments and perished because of sin). We can use various means (such as votes) to oppose excessive government spending and the continued accumulation of debt. Personally, we must return to the teachings of the Bible, because all property belongs to God, and we must be faithful and good stewards of God’s property. Individuals should try their best to manage their finances toward the goal of reducing debt and live a life of contentment (“As long as you have food and clothing, be content with it.” [1 Timothy 6:8]).

Note

1. The U.S. Congressional Budget Office estimates that in 2020, medical care for the elderly and disadvantaged groups will account for 25% of federal government expenditures, and Social Security (senior pensions) will account for 22%. The total of the above two will reach 47%. Interest expenses on debt accounted for 14%, defense expenses accounted for 15%, and the remaining general expenses accounted for only 23%. (Congressional Budget Office, http://www.cbo.gov/budget/budget.cfm) The corresponding values in 2004 are: medical care 19%, social security 22%, interest 7%, national defense 20%, and the remaining 32% . See US Government Accountability Office information. (http://gao.gov/cghome/2005/aarp07212005/img1.html)

2. See Wen Yingqian: "The impact of the global financial tsunami, future effects and ways to survive", "The Kingdom of God Magazine" Issue 15, March 2009, pages 6-12.

3. See Wen Yingqian: "The Impact of the United States' Twin Deficits on the World Economy", "The Kingdom of God Magazine" Issue 2, December 2005, pp. 9-13.

4. See http://en.wikipedia.org/wiki/United_States_public_debt.

5. The US National Debt Clock was sponsored by New York real estate developer Durst and placed in Manhattan Plaza in New York City. It updates the total amount of the US federal public debt and the number that each person has to bear every day. The purpose is to appeal Government reduces debt. A web page with estimates is available at http://www.brillig.com/debt_clock/.

6. According to statistics, as of April 2010, of the total US$3.9574 billion in US public debt owned by foreigners, China accounted for 900.2 billion US dollars, accounting for the first place (23%), followed by Japan with 795.5 billion US dollars (20%), and the United Kingdom. It ranked third (9%) with NT$321.2 billion, and Taiwan ranked eighth (NT$126.9 billion) (3%). See http://www.ustreas.gov/tic/mfh.txt.

7. "PIIGS" evolved from the word "PIGS", which was originally used to describe the four southern European countries of Portugal, Italy, Greece, and Spain. They were once regarded as the "golden pigs" of Europe due to their rapid economic growth. , but after the financial crisis, they and Ireland, which was also highly indebted, became "black pigs". (Information comes from the Internet)

8. The U.S. Congress passed the financial reform bill on July 15, 2010, with the purpose of preventing the recurrence of the financial crisis.

9. The proposition of Alberto Alesina, professor of economics at Harvard University, is based on the experience of rich countries in the 1980s. His views were also quoted in the official communiqué of the EU Finance Ministers' Meeting. However, some economists hold objections and believe that when interest rates are too low, government spending should be increased to avoid falling into the dilemma of Japan's lost decade in the 1990s. (See Bloomberg Business week, 7/02/2010)

10. Founded in 1999, the Group of Twenty has become the main country driving the global economy. Its members include: the United States, Japan, Germany, France, the United Kingdom, Canada, Italy, Australia, Russia and major developing countries. Countries, China, India, Brazil, South Korea, Argentina, Indonesia, Mexico, Saudi Arabia and Turkey, South Africa, plus the European Union.

11. See http://nationaldayofprayer.org/news/save-the-national-day-of-prayer/

12. See Willaim R. Cline, The united States as a Debtor Nation, Institute for International Economics, 9/2005. http://www.iie.com/publications/briefs/us-debtor.pdf

Author Bio:

Author Bio:

Wen Yingqian is currently an honorary professor at National Dong Hwa University in Taiwan. (Personal blog: www.ykwen.blogspot.com)