Discussing the oil crisis from the perspective of soaring oil prices

[New Management Knowledge]

Due to the sharp rise in international crude oil prices in the past six months, price tags at gas stations around the world have changed every week, and this is also the case in the United States. When everyone refuels, they find that the price of gas is much higher than before. Although the price of gas has shown a slight downward trend since the end of November 2004, it is still high compared with the past few years. The sharp rise in oil prices has also affected the retail prices of natural gas and other energy and electricity. In particular, the tsunami in South Asia at the end of last year killed hundreds of thousands of people and displaced millions of people, which may also affect energy prices to rise again. Why have oil prices soared recently? What are the future trends? Has the era of high oil prices arrived? How do high oil prices affect us? How should we respond? This is some information and opinions that this article wants to provide readers.

The recent rise in oil prices

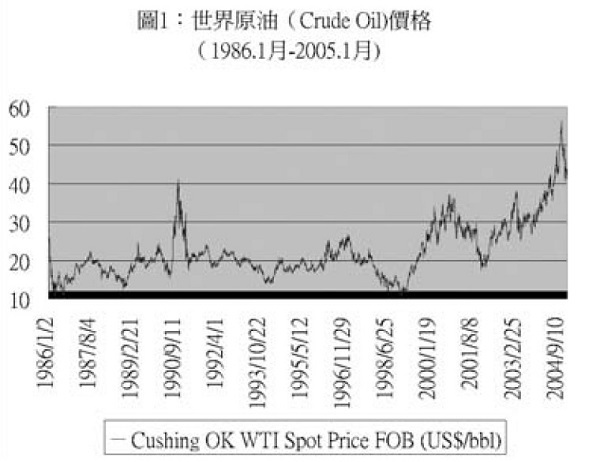

Regarding the rising trend of international crude oil prices, please see Figure 1, which shows the fluctuations in oil prices in the international crude oil spot market from the beginning of 1986 to early January 2005. First, let’s look at the current price of U.S. crude oil brand WTI, which was as high as US$49-56 per barrel from October to November 2004, but fell back to US$40 per barrel in mid-December. The average oil price in the fourth quarter of 2004 was US$51, which was a full US$20 higher than that in the fourth quarter of 2003. If we look at trends, oil prices in 2004 were three times what they were in 1998. Note that oil prices also rose for a time around 2001, but not as much as the sharp rise that began in the second half of 2004.

The rise in crude oil prices is immediately reflected in the prices of gasoline, jet fuel and other energy sources on the market. Taking gasoline as an example, Figure 2 shows the retail price per gallon of gasoline in the Northeastern United States (taking the well-known regular gasoline as an example). Gasoline prices were said to be stable in the 1990s, and began to show signs of rising in 2000. However, the increase began to accelerate from 2003 to 2004, and by 2004 it could be said to have soared.

Other energy prices such as natural gas, fuel oil, heating oil in winter, etc. also rise. For an average household in the Northeastern United States, for example, the average price of heating oil in the winter of 2004 was 37% higher than in the winter of 2003, and the price of natural gas also rose by 15%.

Reasons for rising oil prices

International crude oil prices began to show signs of rising sharply in the second half of 2003, and many factors happened to come together to trigger this oil price fluctuation. Oil price fluctuations are affected by the interactive operation of supply and demand, as well as by speculators' speculation in the futures market. In addition, the U.S. dollar has depreciated against major currencies since 2002 due to the increase in the federal government's budget deficit and foreign trade deficit, and is priced in U.S. dollars. Oil prices naturally rise. The price of metals and minerals in US dollars has increased by 60% compared with 2001. Although the price of oil has only increased by 40%, it has the greatest impact on the entire economy. In terms of supply, the obstruction of oil production in important oil-producing countries is an important factor: for example, the U.S. war on Iraq has reduced the supply of crude oil; the oil-producing country Venezuela has had labor disputes, which has affected oil production; the situation in Nigeria has been unstable for a while; in September 2004 Hurricane Ivan in the Gulf of Mexico in the middle of the month temporarily halted crude oil production in the region, reducing production by 500,000 barrels per day. It recovered somewhat in November, but still produced less than 200,000 barrels per day, which is also the reason for short-term fluctuations in oil prices. In 2004, the world economic boom began to recover, and the demand for raw materials began to increase. However, the supply could not keep up with the demand, resulting in a sharp rise in the price of raw materials, including oil. The rapid economic development of mainland China has significantly increased the demand for imported raw materials, which is also one of the reasons for the rise in oil prices.

Impact of rising oil prices

First of all, the two items of food and fuel in the consumer price index are called core prices, which means that if there is a large fluctuation, the prices of other goods or services will be affected, resulting in The rise in prices of other commodities creates general inflation, which in turn affects the economic growth rate.

Some analysts believe that every recession in the United States after World War II was related to the sharp rise in oil prices. The global economic downturn caused by the oil crises of 1973 and 1979 is still vivid in everyone's memory. At present, oil prices remain high, and it is generally predicted that the global economic growth rate in 2005 will slow down as a result. Rising oil prices are good for oil-producing countries, but have a more serious impact on the prosperity of oil-importing countries, especially poorer oil-importing countries, because these countries have to pay more for oil or other raw materials, which will compress the supply of other items. Imports, for example to Latin American or African countries, make them poorer.

其次,是有關國民所得的移轉效果。根據國際貨幣基金(IMF)研究,油價上升美金5元將使石油輸入國的國內總生產值(GDP)的14%移轉到石油輸出國手中。在一個國家內,石油消費者的部分收入也會移轉到石油生產者手中。

Past long-term trends in oil prices

Although everyone feels that oil prices have risen a lot recently, the real oil prices calculated based on fixed year prices (that is, the price after removing inflation factors) have not yet reached their peak. In terms of nominal prices, oil prices have recently reached a record high, close to $60 per barrel. However, if we look at real prices, oil prices have recorded higher in the past. Figure 3 shows the price of crude oil from 1861 to 2004. The solid line represents the current price, and the dotted line represents the real price with 2004 as the base period. We can see that the price of crude oil in 1863-1972 was higher than that in 1986-99, and in 1973-1979 Real prices were about the same during the oil crisis. The current price between 1999 and 2004 did rise significantly, but if converted into real prices, it is still not a record high. The forward crude oil price, which predicts crude oil prices, will still show a downward trend in the next few years, indicating that there will not be much problem with oil supply and demand in the short term in the next few years.

Global oil supply and demand and oil prices

The level of oil prices is basically determined by the supply and demand of world oil (referring to usable petroleum products after refining) and the oil of each country. Figure 4 shows global daily oil supply and demand during 2003-2005. The total global demand in 2004 was estimated at 82.5 million barrels per day, which translates into a total demand of 30.11 billion barrels for the year; supply was 83.0 million barrels per day, or 30.30 billion barrels for the year, with an oversupply of approximately 183 million barrels. There is no problem with the supply and demand of world crude oil in 2004-2005. It is worth noting that China's demand for oil has surpassed Japan in 2004, becoming the second largest consumer country after the United States, and its economic strength also ranks second in the world.

On the supply side, the Organization of the Petroleum Exporting Countries (OPEC) is still the largest oil producer. When oil prices soared in 2004, it also increased its production to a record high since the 1970s, reaching 29.9 million barrels per day in October 2004. Increased oil production from non-OPEC countries helped offset the impact of higher demand. 70% of these non-OPEC production increases come from Russia and neighboring countries.

In 2004, the 15 largest oil-producing countries were Saudi Arabia (10.2 million barrels per day), Russia (9.1), the United States (8.8), Iran, Mexico, China, Norway, Canada, Venezuela, the United Kingdom, Kuwait, Nigeria, UK, Iraq, Brazil. Of the 10 countries producing more than 2 million barrels per day, five are from the Middle East. However, the uncertain situation in some countries such as Iraq, Nigeria, Venezuela, and Russia will affect their oil production and supply. Seven of the above-mentioned 15 countries are members of the OPEC organization, and the other eight are non-OPEC members, and they also play a decisive role in determining oil prices.

Global oil supply and demand and short-term oil price trends

Based on the above estimates of global oil supply and demand, the US EIA predicts that crude oil prices are expected to return to US$40 per barrel in 2005-2006. The World Bank predicts that the average real price of crude oil will drop from US$39 per barrel in 2004 to US$36 in 2005 and US$32 in 2006. According to World Bank estimates, OPEC's excess production capacity was 4.6 million barrels per day in 2001, but shrunk to 1.4 million barrels per day in 2004, putting pressure on the continued rise in oil prices in the future. With supply decreasing or flat and demand rising every year, oil prices are likely to remain high for years to come.

World oil reserves (reserves) and long-term oil prices

未來的長期油價也受到世界石油地下存儲量的影響。世界已知石油存儲量雖然過去每年都有增加,但未來可能要越掘越深,才能採到石油,開採成本將因此而增加。全世界石油儲存量到底多少,估計不一。根據不同機構估計,2003年底已證實的(約11-12,000億桶)加上待發現可能儲存量因此總共約28,000-29,000億桶可供未來使用。全球需求如果維持在2005年的84.5百萬日桶,則全年共需約309億桶,全球的石油只能維持約94年,也就是本世紀末就無油可用了。何況石油的需求幾乎每年都在增加,如果沒有開發新的能源,也許到本世紀中葉後就無石油可用。國際能源總署2004年世界能源展望測估未來三十年全球能源的需求將增加百分之六十,其中百分之八十五為石油。能源消費增加,也會使溫室效應更加嚴重。當石油越來越少,或開採成本越來越高時,油價就會大幅上升,屆時就會發生真正的石油危機。

Political factors also influence oil production. Iraq is one of the second or third largest oil storage countries in the world (similar to Iran), but the US-Iraq war has caused abnormal oil production in the country. Russian oil production has suffered from poor financial management due to the privatization of the oil industry, which has affected oil production. Low inventories, low production, and instability have created an imbalance between oil supply and demand. If there is unrest in Saudi Arabia, the largest oil-producing country, the situation will be out of control.

Interestingly, Islamic countries account for about 70% of the world's proven oil reserves. Muslim Arabs claim to be descendants of Ishmael, another son of Abraham. Genesis mentions God’s promise to Abraham that Ishmael’s descendants would become a great nation and live “east of the brethren” (Genesis 16:12, 17:20, 21:13 Section. ) The U.S. war in Iraq and its involvement in the Israeli-Palestinian conflict have intensified the conflict between Muslims and Christians. It remains to be seen whether oil will trigger world turmoil in the future and fulfill the doomsday prophecies mentioned in the Bible (Revelation 6 mentions rising prices due to war).

Natural disasters can also trigger energy crises. The global greenhouse effect, frequent earthquakes, and the recent tsunami in South Asia all point to increasingly serious disasters on the earth, and disaster relief operations also consume a lot of energy.

Summary: U.S. oil supply, demand and response

People living in the United States are blessed. The population of the United States was 291 million in 2003, accounting for only 4.7% of the global population. However, it is the world's largest energy consumer and the country with the least restraint. In 2003, total U.S. oil consumption was 20.04 million barrels per day, accounting for a quarter of total global demand. In addition to oil consumption and many raw materials accounting for the largest consumption in the world, carbon dioxide emissions that are harmful to the environment also account for 24.4% of the world's emissions. Among petroleum consumption, transportation gasoline accounts for the largest amount, accounting for 8.94 million barrels per day (45%), and the rest is fuel and aircraft oil. Gas prices in the United States are among the cheapest at gas stations in the world. Gas prices are often lower than bottled water bought in supermarkets. Gasoline in Eurasian countries is as high as $4 per gallon, but in the United States it is only $1-2. Since the crude oil price crises of 1973 and 1979, crude oil prices have in fact remained low in real terms.

In the 1990s, when car engines and home heating and cooling machines became more efficient, Americans bought large luxury cars and built larger homes. From 1990 to 2003, the average American home size increased by 200 square feet, to 2,330 square feet. Although there are more fuel-efficient machines and cars, Americans use more energy. During the U.S. election, presidential candidates from both parties advocated increasing government funding for the research and development of alternative energy solutions, such as the development of wind power, solar energy, hydrogen batteries, new coal power plants, etc.

In the face of long-term high oil prices, as Christians, we need to develop the habit of saving energy to protect the earth's resources so that future generations can enjoy the same standard of living as us. There are many ways to save energy available on the Internet, which are worth your reference. For example, filling holes, strengthening insulation materials, hiring a specialized company to find out the holes in the house and repairing them, replacing them with low-emissivity coating (low-e) windows, etc. (You can refer to the various energy-saving methods provided by the website www.energystar.gov).

Source and period of data in the attached table:

Figure 1: Source: US Energy Information Administration, Cushing, OK WTI Spot Price FOB ($/bbl). Period: 1986/1/02 to 2005/1/04.

圖2: 資料來源:US Energy Information Administration。時期:1992年5月11日至2005年1月3日。

圖3: 資料來源:US Energy Information Administration (1861-1999), Go Tech (2000-2004)。 時期:1861-1944 US Average ; 1945-1985 Arabian Light posted at Ras Tanura;1986-1999 Brent spot;2000-2004 NYMEX Light Sweet。 價格1861-1999錄自EIA資料,2000-2004價格以美國消費者物價指數不含能源為準。

Author profile

Author profile

Wen Yingqian is currently a professor at the Department of Economics at National Dong Hwa University in Hualien, Taiwan. He holds the Chartered Financial Analyst qualification from the United States and has served as an economic expert at the World Bank for more than 20 years. PhD in political economics from Johns Hopkins University, USA.