Financial Risk Management: Healthcare

【Personal Finance Series】

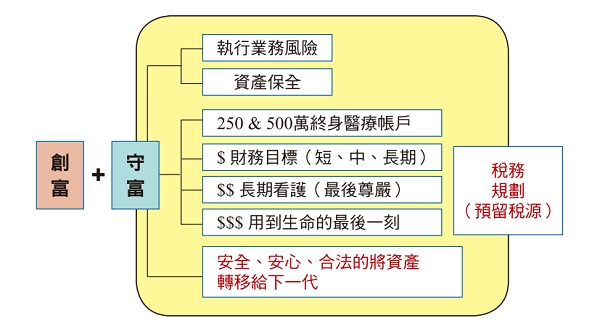

God has given us the ability to make money. Is there a correct order to follow in financial allocation and management? Proverbs 28:22 warns: "A person has an evil eye and wants to get rich quickly, but he does not know that poverty will surely come to him." Therefore, before investing in stocks, funds, real estate, etc., do not want to get rich quickly, but do a good job in risk management. Financial planning is very important. Ecclesiastes 11:2 mentions the importance of spreading risks, "Give it to seven, or to eight, for you do not know what calamity will befall the earth in the future." Therefore, equally important as accumulating wealth is How to keep the wealth given by God, give our family a good life, realize our life dreams, and do all the good things God wants us to do.

In addition to the basic tithing of the income earned, how can we make safe financial planning for the rest? There are several steps you can take:

1. Complete lifelong medical insurance plan;

2. Short, medium and long-term financial goal planning;

3. Lifelong long-term care planning;

4. Pension planning available until the last day of life;

5. Asset preservation planning required for execution of business risks;

6. Gift planning to pass wealth to the next generation legally and safely;

7. Inheritance tax planning with reserved tax sources.

8. National financial contribution plan.

In this issue, I will first share with you a complete lifelong medical plan. (This article describes mainly Taiwan’s medical and insurance systems.)

Ecclesiastes 3:1 says: “There is a season for everything, and a time for everything under the heaven.” Since God is in control and has His timetable, we don’t know what the future will be like, but God has given us the ability to work and earn money. , it is necessary to do a good job in distribution and management.

In Taiwan, there are a wide variety of medical insurance products. The complete medical part should include lifelong medical treatment, lifelong surgery, lifelong cancer prevention, medical out-of-pocket expenses, accident insurance, accidental hospitalization daily amount, accidental out-of-pocket expenses and premium exemption. Only with the above items can it be called a complete medical plan. It is worth noting that medical insurance planning is closely related to physical health and age. In fact, the premium is not high, especially lower than the cost of savings insurance planning. However, the traditional concept of saving money and thinking that medical insurance is wasting money if it is not used has caused a negative impact on people. The neglect of this most basic but important plan leads to the lack of insurance when you are old and sick. By then it is too late to buy insurance, which requires family care and huge medical expenses. This affects your life, affects your children, makes you unable to contribute, and even leaves you in need. Brothers and sisters in the church raise funds to help and other dilemmas.

Why do you need medical insurance planning, especially lifelong medical planning? There are three reasons: 1) If you become sick or hospitalized when you are able to work and earn money, medical claims can make up for the lack of income. 2) After retirement, you can use it to pay for medical expenses without withdrawing your pension to pay for medical expenses; 3) Currently, many medical expenses in Taiwan are not covered by the National Health Insurance, and medical insurance can make up for the lack of National Health Insurance coverage.

lifetime medical insurance

In Taiwan, you basically have to pay for ten, fifteen or twenty years, during which the premium will not be increased, and you don’t have to pay anymore after the payment period expires. Lifelong medical insurance refers to lifelong medical protection within the insured limit. The coverage is mainly based on hospitalization daily benefits. If there is no hospitalization, there will be no claims. Currently in Taiwan, the maximum insurance age varies from insurance company to insurance company. Most of them set the upper limit of insurance age at 60 or 65 years old.

Since there is so-called lifelong medical treatment, there is also so-called regular medical treatment. The so-called regular policy means that within a certain period of time, premiums must be paid continuously to keep the policy in effect. The premiums will also increase with age. In Taiwan, it is generally common practice to continue paying premiums until the age of seventy or seventy-five, and insurance companies will no longer provide protection. I often describe regular medical insurance as renting a house with a landlord. The rent will continue to increase. Even if you pay rent for a lifetime, in the end, the house still belongs to the landlord.

The current average age of women in Taiwan is 82 years old and that of men is 78 years old. If you do not plan for lifelong medical insurance when you are young, you will not have medical protection when you need it most when you are old. In particular, in the past, Taiwan’s policy plans were mostly based on whole life insurance, with the main payment period being 20 years, and many regular medical insurance add-ons. Almost all customers and friends thought that after the payment was completed in about 20 years, all the protection would be lifelong. However, all riders must continue to pay to be valid. When the time limit expires, there will be no medical coverage at all, causing great panic for many families. If you have a lifelong medical insurance plan, you will be paid a daily ward benefit when you are hospitalized. You can choose a one- or two-person ward so that you and your family members can have a better rest. Otherwise, you can only squeeze into a four-, six- or even eight-person health insurance ward. Inside, the golden period of rest and relaxation is lost.

Lifetime surgery insurance

The situation of lifetime surgery insurance and regular surgery insurance is roughly the same as that of medical insurance. The main difference is: does the surgery require hospitalization or can claims be paid for outpatient surgeries? With the current continuous advancement of medical technology and technology, many surgeries no longer require hospitalization and can be completed in outpatient clinics, so please pay special attention to whether outpatient surgeries are covered by claims. In addition, since many surgeries require an increasing proportion of out-of-pocket expenses, such as the installation of heart stents, pacemakers, artificial joints, etc., if we plan lifetime surgical insurance, no matter how old we are, we will have greater coverage when surgical medical actions occur. Choose more opportunities for better medical quality and recovery.

In particular, Taiwan's current lifetime medical and lifetime surgical insurances mostly come with a mechanism to claim unused interest on premiums paid, as well as a claim-free value-added bonus, an old-age value-added bonus and other mechanisms to combat inflation. They are insurances worth configuring. planning. As for the relationship between whole life insurance and long-term care insurance, which many people are concerned about, it will be explained in the next issue.

Lifetime cancer insurance

Cancer planning is divided into lifelong cancer prevention and regular cancer prevention. So far, most lifetime cancer insurance policies require payment for twenty years and lifetime protection. However, the author also found that many lifetime cancer insurance policies require payment for life, even until the age of ninety-five, and the premiums will also increase with age. Increase, this is a part that deserves special attention and review.

Medical out-of-pocket insurance

Medical care is paid out of pocket, and the main claim content is the same as lifelong medical care, with hospitalization as a prerequisite. The principle is based on the daily amount of hospitalization, payment of hospitalization medical expenses, and payment of surgical expenses, which is the so-called self-pay part of the subsidy. At present, most of them are based on regular medical out-of-pocket payment, out-of-pocket payment or fixed benefit, whichever is higher. The maximum insured age is between 60 and 80 years old. The premium will increase with age and is based on the actual content listed in the policy.

Accident insurance/Accidental hospitalization daily amount/Accidental medical out-of-pocket insurance

Accident insurance is also called injury insurance. Most people think that as long as an accident occurs, they can be compensated regardless of hospitalization or medical treatment. In fact, the coverage of accident insurance only initiates claims when death and disability are caused by an accident, and does not include accidental hospitalization and accidental medical treatment. Therefore, when planning accident insurance, be sure to add accident (injury) hospitalization days and accident (injury) out-of-pocket medical benefits under the accident (injury) insurance. In recent years, many unexpected savings planning products have appeared in Taiwan, combining unexpected events with savings. Readers are reminded here to pay attention to whether it is really their needs. Otherwise, it is recommended to return accidents to accidents and savings to savings. Don’t pay a lot more premiums because you save for accident insurance, and do not get more accident protection!

Premium waived

Waiver of premium is the most easily overlooked part by most people; Waiver of premium is to buy another insurance for insurance planning. When the applicant or the insured suffers from a critical illness, disease or accidental disability level listed in the terms and conditions, the function will be activated that does not require continued payment of premiums but the entire policy will continue to be valid. That is, if the above situation occurs, the insurance company will help with the insurance plan to pay all undue premiums. This will avoid the dilemma of having to continue to pay premiums when you are unable to work or your income is reduced due to illness or accident.

When planning a complete medical insurance, it is recommended to plan basic lifelong medical care, lifelong surgery, lifelong cancer prevention, medical out-of-pocket expenses, accident insurance, accidental hospitalization, accidental medical out-of-pocket expenses, premium exemption, and then follow each person's own responsibilities With the income budget, increase the amount of the above regular planning. Readers are requested to break the myth that "lifelong medical, lifelong surgery, and lifelong cancer insurance plans are expensive" (currently, taking a thirty-year-old male as an example, the above complete set of premiums is about NT$36,000 per year), and only plan for regular medical insurance , may lose big in the future. As long as the planning is correct and the cost is not high, there will be no need to use the saved retirement funds to pay for old-age medical expenses in the future, and it will also avoid causing pressure on children's lives, finances, and even emotional damage. If you have been delaying in purchasing lifelong medical insurance, the older you are, the higher the premium will be, and the risk of rejection due to age or physical condition will increase. In order to plan a complete lifelong medical insurance, insurance practitioners must not only have more specialties, but also need to invest in long-term care and claims services for customers in the future. Therefore, some business personnel will plan very expensive lifelong medical insurance for customers, making customers think that there is lifelong medical insurance. It is very expensive, so instead plan a savings insurance. This not only conforms to the mentality of Chinese people who love saving, but also reduces the trouble of insurance practitioners themselves in future claims settlement services. To refresh the reader's understanding of the sequence of financial planning, please refer to the attached diagram.

Psalm 90:10 says, “The days of our life are seventy years, or even eighty if we are strong; but the glory in them is only toil and sorrow, which are gone in a flash, and we fly away. "The number of years in our life is in God's hands, but in addition to giving us the ability to make money, God also exhorts us in Psalm 90:12: "Teach us how to number our days, so that we may gain wisdom. "God teaches us and gives us a wise heart to manage the use of money and financial planning according to God's will. When we are sick or old, our lifelong medical risks have already been transferred to insurance companies. I wish all readers that with correct medical insurance planning, they will have more wealth to sustainably contribute to the church and the Kingdom of God, and be used by God.

Pan Huating, general manager of Gabriel International Wealth Management Consulting Co., Ltd., founder of Gabriel Saint Financial Team, CEO of Taiwan Aetna Insurance Brokers Company, holds international financial planner and psychological counselor certificates, and is a member of the Chinese Boaz Association Teacher at Joshua School of Management. He loves life and devotes himself wholeheartedly to domestic and foreign gospel ministries, serving the disadvantaged in rural areas and poverty alleviation projects. He also participates in the ministries of entrepreneurs achieving kingdom enterprises and the Great Commission, and using his life to influence lives.

Pan Huating, general manager of Gabriel International Wealth Management Consulting Co., Ltd., founder of Gabriel Saint Financial Team, CEO of Taiwan Aetna Insurance Brokers Company, holds international financial planner and psychological counselor certificates, and is a member of the Chinese Boaz Association Teacher at Joshua School of Management. He loves life and devotes himself wholeheartedly to domestic and foreign gospel ministries, serving the disadvantaged in rural areas and poverty alleviation projects. He also participates in the ministries of entrepreneurs achieving kingdom enterprises and the Great Commission, and using his life to influence lives.