Mind management, family management, financial management

▲Cleaning up is to remove the fetters of people and things, enjoy spiritual wealth, and live a rich life.

In the era of high interest rates, high inflation, and high housing prices (rents), do you feel worried or stressed? How to relieve stress and relieve anxiety?

The epidemic has changed many people's lifestyles and thinking, and has also caused many people to face economic challenges. How to adjust accordingly? How to effectively manage the assets in hand? How can we receive God’s blessings financially, or even bless others with our wealth? How to make ends meet? How can we peel off the layers of tangled environmental and personal problems and break through to victory?

The National Consumer Price Index (Core Price Index) released by the U.S. Federal Department of Labor shows that the overall inflation rate has reached an annual growth rate of 8.5% in July 2022, and the bank interest rate is 2.3%; the speed at which everything is rising has reached a record high 40-year high. The purchasing power of money has shrunk and the cost of living has risen, adding to the pressure on families across the United States. "Cash is king", which has always been regarded as a guideline in the financial management industry, is no longer an absolute concept.

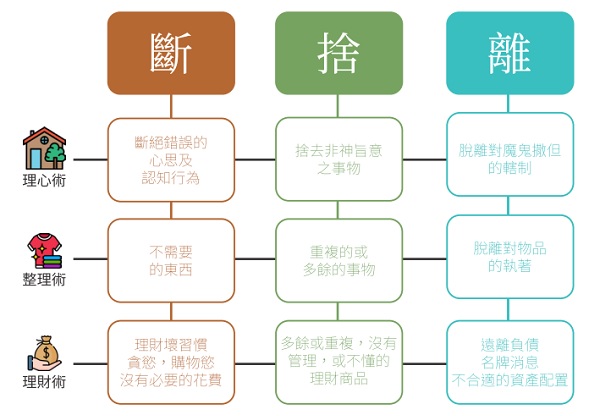

The "decluttering" organizing technique that has become popular in recent years is to simplify life. Cut off - get rid of unnecessary things; give up - let go of repetitive or redundant things; leave - break away from attachment to items.

Many people think that “departure” is just about tidying up the “external” items at home. In fact, the focus of "breaking away" lies in "psychology" - by discarding useless things, sorting out consumption behaviors caused by habits or stocking up, restoring a clean and tidy home, and achieving a change in mood. After getting rid of the reluctance and attachment to items, you can then add happiness and beauty, making you feel comfortable and happy.

Based on my past experience in financial management and from personal families who have gained financial freedom, I have learned from God the priorities of financial management: mental management→family management→debt management→financial management. There are many references in the Bible to the concept of separation of mind, family, and financial management.

Cut off - cut off wrong thoughts and cognitive behaviors; abandon - let go of things that are not God's will; leave - break away from the control of Satan.

rationality

There are 2,350 verses in the Bible that talk about money; half of the parables Jesus told dealt with money. God loves to use money to teach lessons about character and life. In fact, managing money is to manage the mind. Before managing money, you must first manage the mind.

"Changes in people start from the heart. When the mind changes, the attitude changes; when the attitude changes, the habits change; when the habits change, the personality changes; when the personality changes, the direction of life changes."Psychologist Abraham Maslow mentioned it in the book "Excitement and Personality".

I have interviewed families who have experienced financial crises, and found that their turning point is "psychology"; from the initial pain, fear, fear, and powerlessness, to asking God for guidance. Mental health is not only to keep the heart clean, but also to hand over the key to the heart and let Jesus become the master of the heart. With faith and God’s guidance, we move forward step by step and finally reach our goal.

God also gives us resources to equip us to deal with money-related problems. We should make good use of the talents, time and wealth given by God, and be faithful, kind and knowledgeable stewards according to God's will, so that others can benefit and God will be glorified.

Manage the house

The parable in Matthew 12 says that an unclean spirit leaves a house and brings an even worse spirit back into a clean house. This passage reminds us that managing a home is not just about renovating your own house, but more importantly, asking the Lord to be the master of your life and focusing on communicating and building a relationship with God. A life cleansed and filled with the sin-forgiving grace and joy of Christ.

The "breaking away" organization technique of home life is to get rid of the shackles of old ideas and do better and simpler things.

For example, clear out household clutter and keep only the necessities; donate or give away clothes that you have never worn or of similar styles; replace physical books with e-books, which is environmentally friendly and does not require hoarding items to take up space.

Simplifying material life can help maintain a happy mood, find happiness from contentment, and build satisfaction at the level of heart and soul.

financial management

How to apply the concept of renunciation to financial management?

Quit: Quit the desire to shop

Before purchasing, ask yourself: “Want” or “Need”? Don't spend impulsively.

Stop for a moment before buying something, and look again after a few days; usually "wanting" it only lasts a moment, and after that, you realize that it doesn't matter if you don't buy it. In an era of material abundance, there may not be many things that are actually "needed", and many times the desire to shop stems from dissatisfaction with life.

Quit: Quit unnecessary habitual expenses

Latte, precious milk, snacks, purses, subscriptions, etc. All consumption behaviors arising from habits and inadvertent expenditures can be regarded as "latte factor", "milk factor", "Amazon factor"... ….

I love drinking bubble milk tea. Due to my personal consumption habits, I almost caused high blood sugar and blood lipids, and the money spent on it also affected my health. Some people unknowingly stock up their garages due to the convenience of online shopping. These irrational consumption behaviors are sunk costs (Sunk Costs, which refer to costs that cannot be recovered). Effective moderation can save a lot of expenses. For example, drinking one less cup of latte every day saves $5 US dollars, which is $1800 a year, which can be used for regular fixed investment.

I want to emphasize the practice of renunciation and subtraction in life. It doesn’t mean that you don’t enjoy life or have no quality of life, nor is it mean to be stingy, spend every penny, give up on dreams, dedication, etc.

break: breakBad financial habits stemming from greed and fear

Reject short-term speculation and replace it with long-term investment. The market panic mentality of chasing highs and selling lows will bring anxiety and affect investment decisions. Due to the pressure of life, I invested in high-risk products and wanted to get rich quickly with small bets, but ended up in trouble. When there is too much information and a lack of discernment, it is easy to be carried away by various news and trends. The starting point is speculation, not investment.

The crux of bad habits in financial management is the human heart, which relies on one’s own ideas instead of seeking the guidance of the Holy Spirit and allowing the Lord to take control of every financial decision.

Abandonment: Abandon unmanaged financial products

Are the stocks and funds in your hands disorganized and mostly locked up? Is there a stop loss point?

It is necessary to regularly review the total personal assets, such as savings, insurance, stocks, funds, investment properties, and retirement savings such as 401K. Abandon industries that you don't understand or are familiar with, and focus on familiar financial products to avoid neglecting management, missing good investment opportunities or causing losses.

The same goes for credit cards. As a result, the number of credit cards and consumption continued to increase. Please count the number of personal credit cards and ask yourself: Will extra credit cards add to the hassle and extra expenses. Get rid of redundant credit cards, which are convenient to manage and can moderately avoid impulsive consumption.

Stay away from debts and unsuitable assetsProduceConfiguration

Regarding debt, Proverbs 22:7 teaches: “The rich have dominion over the poor, but the debtor is his servant.” Legally, debts must be repaid first, and we cannot spend our income as we please. There is no other way to get out of debt, which is to live within your means and avoid debt; plan your repayments and get out of debt as soon as possible.

Review and readjust your balance sheet according to different life stages to make the most appropriate asset allocation. For example, if you have a savings account during your student days, you may be able to turn part of your cash into investments that suit your personal goals and increase your passive income after you enter a period of stable work income.

Regularly observing the performance of investment projects, assessing whether adjustments are needed at the appropriate time, and matching investment goals and risk tolerance are a very important part of financial management.

The proverb says, “Diligence in planning leads to prosperity.” Among them, the original meaning of diligent planning in Hebrew is that a person holds sand in his palms and puts it into a big bucket one by one. Gradually the bucket becomes full and overflows.

To be a successful investor, you need to spend less than you earn and then save and invest consistently over the long term.

Receive God’s Abundance from Simplicity

Manage your mind, your family, and then your finances. First turn your heart to God, trust Him, and seek heavenly vision and wisdom. When we seek His kingdom and righteousness first, we change our priorities in life and trust that God will provide for our needs. Wealth comes from hard work, but hard work is not just to accumulate wealth, but to make good use of the talents given by God to bless more people. Accumulating wealth allows us to live a happy life and have more spare time to serve God and help others.

After sorting out life through "dissociation", you will find that "simplicity is beautiful", and you will no longer seek security and satisfaction from tangible materials, but from your heart and spirit you will "not be lacking" and "not lacking in any good thing".

Even in the era of high interest rates, high inflation, and high housing prices (rents), we can still have spiritual wealth and live an abundant life blessed by God.

▲The original meaning of "diligently planning" in Hebrew is to hold sand in the palm of your hand and put it into a big bucket one by one. Gradually the bucket is full and overflows.

Xu An (Annie)Xu An (Annie), MBA, university finance lecturer, has worked in international financial institutions from customer service, product, marketing to business supervisor, with more than 20 years of wealth management practical and teaching experience. Currently, he is a partner of Boston Angel Fund and a gospel volunteer.