It is more blessed to give than to receive

▲The Lord Jesus encourages and urges His followers to demonstrate their faith in God and love for people through donations.

Instructions of truth

Among the principles for Christian behavior, support for the Kingdom of God, poverty alleviation, and generous donations to those in need are undoubtedly one of the key points. God tells Christians this:

1. Matthew 25:34-45. This is the last teaching Jesus gave to his disciples before his crucifixion, reminding him of the importance the Lord attaches to generous acts of helping others in the last judgment.

Then the king will say to those on his right, "Come, you who have been blessed by my Father, inherit the kingdom prepared for you from the foundation of the world. For I was hungry and you gave me something to eat, and I was thirsty and you gave me something to eat." Drink; I was a stranger and you welcomed me; I was naked and you clothed me; I was sick and you visited me; I was in prison and you came to see me...Truly I say to you, since you have done these things. If you do it to one of the least of these my brothers, you do it to me.”

2. Acts 20:17-38. Paul established the church in Ephesus and spent three years getting along with the congregation and becoming close to his family. In this final meeting after the separation of life and death, the elders were reminded to remember the words of the Lord Jesus, "It is more blessed to give than to receive," and to help and support the weak.

Paul sent from Miletus to Ephesus to invite the elders of the church. When they came, Paul said: "...I gave you an example in everything, so that you should work hard and help the weak, and remember the words of the Lord Jesus, which said, It is more blessed to give than to receive." Paul finished speaking. After saying this, he knelt down and prayed with everyone. The crowd wept bitterly, hugged Paul's neck, and kissed him. What saddened them the most was what he said: "You can never see my face again in the future." So they sent him to the ship.

3. Hebrews chapter 13 verses 1-3; verses 15-16. The first 12 chapters of Hebrews explain the salvation of Christ in place of the sacrifices and atonement of the Old Testament. The last chapter reminds the Jews to do good and be compassionate in daily life. At the end, it again exhorts the believing Jews to praise God with words and not to forget to do good and be kind. Donate and compare this behavior to a sacrifice, which pleases God.

Always have brotherly love among yourselves, and do not forget to welcome strangers with love; for some who welcomed strangers unknowingly welcomed angels. Remember those who are in bondage, as if you were in bondage with them; and remember those who are being tortured, as if you too were in the body. Through Jesus we should always offer up a sacrifice of praise to God, which is the fruit of lips that acknowledge the name of the Lord. But do not forget to do good deeds and donate money, for such sacrifices are pleasing to God.

From these verses, it is not difficult to see that the Lord Jesus encourages and urges His followers to demonstrate their faith in God and love for others through donations. What are some ways to help us practice the Lord’s commands with a good stewardship attitude?

Giving Circle (Giving Circle)

Human life as a whole has improved a lot, but challenges such as social polarization between rich and poor, racial discrimination, degradation of the ecological environment, and even disease medical treatment and epidemic prevention still exist. Although these challenges urgently require Christians to participate in the solution out of love for the Lord, it cannot be effective just by the efforts of individual Christians to participate.

美國一所大學的慈善研究在《2018年11個公益新趨勢》的報導中,位列榜首的是「共同捐贈」(Giving Together), 提到捐贈圈的崛起。另一報導指出2007到2016的十年間,美國捐贈圈的數量增長近三倍,年複合增長率約為25.9%。1

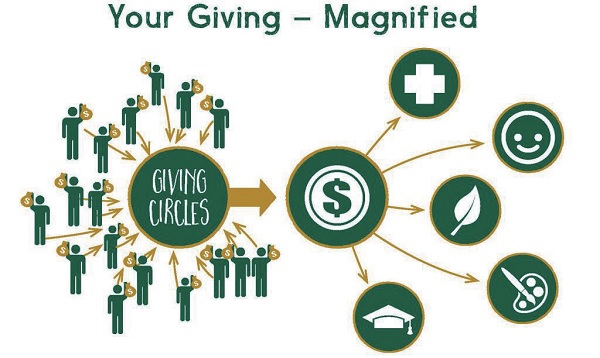

Donation circles are similar to investment clubs. Like-minded members gather funds and jointly decide where to invest funds through analysis and research. The difference is that the latter aims to maximize profits, while the former seeks to expand charitable influence.

Donation circles have the advantages of gathering strength to accomplish big things and reducing costs, etc., and have the following impacts on charitable donors:

1. Conducive to strategic donations. Assist in donation decisions through in-depth investigation and analysis of relevant data by organizational members. It’s also good for making long-term donations;

2. By organizing lectures, forums, and on-site visits, we can effectively enhance donors’ knowledge of public welfare and help guide the scientific use of donations.

It is not something that can be taken for granted by working together to build a consensus on the target and amount of donations. Internally, relevant procedures for discussion, decision-making, and document management need to be established, and externally, legal and compliant donation channels need to be established. Careful Christians can join an existing donation circle affiliated with a local community foundation. After gaining the ability to organize and operate, they can then organize a donation circle in the church or within their own circle of friends. Many churches have social service ministries, and they may also consider encouraging members to participate and practice effective social service ministries through the donation circle model.

▲The donation circle has the advantage of gathering strength to do big things and reduce costs.

(Image Source:https://images.app.goo.gl/Gp45zZ12xvumitdDA)

Donor-Advised Fund (DAF)

The rise of modern non-profit organizations has given a great help to solve the aforementioned social problems and challenges. Most countries recognize and support it and encourage donations to non-profit organizations in the form of tax incentives. The financial sector combines tax incentives, investments, and charity donor-advised funds to add new channels and resources for charitable donations.

1930年代,美國一社區基金會(community foundation)設立第一個DAF。1987年DAF取得稅務優惠,此後快速發展,加上金融背景的投資理財機構,如Fidelity、Schwab、Vanguard等參與而發揚光大。這些金融公司有大量具有捐贈能力的客戶,為基金會提供客戶基礎,使得捐贈人享受便捷、高效的捐贈支持。2

In 2017, The Economist published an article "A philanthropic boom: “donor-advised fund", 3-27-2017, and another Academic paper "Donor Advised Funds: Charitable Spending Vehicles of 21st Century Philanthropy, Washington Law Review" published in the "Washington Law Review". The titles of the two articles straightforwardly explain the rapid growth of DAF in the United States in recent years, and provide in-depth analysis and reporting on its background and future impact.

DAF is a donation model of a public charity organization. The donor invests in setting up a sub-fund under the charitable foundation. Once the donation is completed, it is irrevocable. The donor immediately enjoys the tax benefits of the donation and can make contributions to the fund. Make suggestions on the use and investment of funds, and the charitable foundation has the final authority to donate. The foundation provides donors with professional services to manage DAF accounts; assists in obtaining tax benefits, including the valuation and realization of illiquid assets (such as donated real estate, unlisted company stocks, art collections, etc.); provides a variety of value-added and preserved options; and provides convenient assistance Charitable donation expenditures, including assessing whether suggestions for use of donations are legal and compliant, and assisting in the processing of special objects (such as overseas donations).

DAF不僅對捐贈大戶有吸引力,也對一般小額捐贈人有利,例如:完整的捐贈歷史;便捷的網上捐贈手續;可與家人共同設立捐贈平台和品牌,可以為紀念某人或為家族慈善傳承的基礎;做匿名捐贈而仍享有稅收優惠等等。更值得提的是DAF基金會提供初步慈善顧問性質的協助,促進小額捐款人做長期性、策略性的捐贈。3 2020年的疫情讓DAF發揮其便捷性,

有心人士透過DAF能更有效提供策略性的抗災救援。4 9月底,富達慈善基金會把起始捐贈的門檻從5,000美元降到0,其他的大型DAF基金會料想也會跟進。此舉可望加速原已成長迅速的小額捐贈帳戶的設立,鼓勵更多一般小額捐贈人設立DAF帳戶。5

DAF的實踐也普及美國以外的許多地區。6有心行善的基督徒若尚未設立DAF 帳戶,值得考慮此渠道,可詢問來往的金融機構,如與銀行或投資單位有關聯的DAF基金會。受疫情影響,傳統敬拜過程中實體收奉獻的形式受限制,許多教會進行線上聚會,在設計與執行新的收取奉獻的方式時,也可考慮採用DAF捐贈方式。

▲Whether it is a large or small amount, DAF enables donors to enjoy convenient and efficient donation support.

(Image Source:https://mp.weixin.qq.com/s/VJXIanrzuFwkDKyoR4HQBQ)

Qualified Charitable Distribution (QCD)

In the United States, the amount withdrawn from an individual retirement account (IRA or 401(k)) must be classified as income for the year, and the corresponding income tax must be paid; after reaching the age of 72, a portion of the amount must be withdrawn every year (Required Minimum Distribution, referred to as RMD) and pay corresponding income tax. If the withdrawn amount is donated directly to a charity or church approved by the IRS and marked as QCD, it will not be classified as income for the year and will save taxes.

QCD procedures have special details. For example, donations are sent directly from retirement accounts. The recipient unit may not necessarily know whose account the donation is from, and donation receipts cannot be easily provided. At the same time, QCD also has some restrictions. For example, donations cannot be made to donor-advised funds, and the total amount cannot exceed US$100,000. In addition, due to the special epidemic situation in 2020, the CARES (Coronavirus Aid, Relief, and Economic Security) Act exempted RMD in 2020. In some cases, the amount already withdrawn can be tax refunded.

Directly not included in income, it has a higher tax-efficiency than including charitable donations in itemized deductions. For example, including a donation of $2,000 as itemized deductions, but the total amount of the itemized deductions is less than the standard deduction, will not reduce the total tax liability. If the donation is not directly included in the income, the total taxable amount will be reduced by 2,000 yuan. At this time, assuming that the tax can be saved by 300 yuan, it means that the actual donation cost is only 1,700 yuan, which has a high donation tax effect. High tax efficiency is not the goal, the goal is to increase the ability to donate 2,000 yuan to the ability to donate 2,300 yuan.

The CARES Act of 2020 allows each taxpayer to have $300 in charitable donations that are not included in income. This means that even if itemized deductions are not used, this $300 can still enjoy tax benefits.

有美國個人所得稅義務的年長弟兄姊妹,可以考慮將對教會,和包括「神國資源為基督」等的慈善機構的捐贈,或全部經由QCD途徑,有效降低當年所得稅金額,從而提高捐贈能力。7

Take stock of the past and plan for the future

2020年因疫情的影響,許多非營利組織,包括教會和公益慈善團體,遇到嚴重的財務困難。本刊61期拙作〈Choice in times of trouble〉,寫在新冠疫情嚴重、政治極端對立分化時,提到只有慷慨能拯救我們,也提到我個人的實踐經歷,再次見證利用QCD和DAF的有效便捷。

What kind of year 2021 will be remains to be seen. No matter what, ask God to let us continue to love the Lord and love others, and make good use of all resources with faith and wisdom.

At any time, ask God to help us remember Jesus’ admonition, donate generously, and practice “it is more blessed to give than to receive.”

Note:

- 1. The content of this section is based on< New trends in American philanthropy—the rise of donation circles and their development in China〉, Zhang Yu, 2018-10-18 (http://blog.sina.com.cn/s/blog_626393e60102xzhw.html).

2. This section is based on "American DAF – Everyone can have a "charitable wallet"",He Lili, 2016-11-18, (https://weibo.com/p/230418626393e60102wwt1),and< DAF Foundation with a financial background—a new star in the U.S. public welfare sector>, Xie Jin, 2017-06-30 (https://mp.weixin.qq.com/s/VJXIanrzuFwkDKyoR4HQBQ).

3. Charity relatedconsultantRegarding DAF, please refer to "Philanthropic Advisors in the DAF Environment", He Lili, 2017-07-12, (https://mp.weixin.qq.com/s/ywwG8WvKSlpH4ZWvIX8zxQ)

4. See "How DAF can make donors' disaster relief more strategic", Zhang Yu, 2020-02, (https://mp.weixin.qq.com/s/lf0XHMprJc00CrU8FzpIOA)

5. What No-minimum Donor Advised Funds Could Mean for the Future of Philanthropy, Growfund, November 6, 2020, (https://mygrowfund.org/what-no-minimum-donor-advised-funds-could-mean-for-the-future-of-philanthropy/).

6. Although the tax incentives for donations in mainland China are more restrictive in practice, DAF still has commendable development. For details, please refer to the seventh issue of "Donation Quarterly" (https://mp.weixin.qq.com/s/ZB8gUbDm-RDkqclf5Nz3hA).

7. Relevant tax laws in the United States often change, and SECURE was revised in 2019 ( The Setting Every Community Up for Retirement Enhancement) Act delays RMD from age 70½ to age 72, with some transitional provisions. When planning tax matters, it is advisable to consult a tax advisor or charity advisor.

Jiang Jiaqi, was born in China and grew up in Taiwan. He studied and worked in the United States, and also held management positions in technology companies in Taiwan and China. He taught at Peking University from 2006 to 2017, and served as the executive director of Shanghai Shunyi Charity Consulting Company from 2015 to 2018.