Taiwan life insurance

【Personal Finance Series】

Following the analysis of complete whole-life medical insurance in the previous issue, in this issue we will learn about life insurance.

At present, most of the claims for various commodities in medical insurance are used by the insured themselves. But life insurance is completely different. It includes survival insurance, death insurance, and end-all insurance.

survival insurance: The insurance condition is that the insured is still alive when the agreed insurance period expires.

death insurance: The insurance condition is based on the death of the insured within the insurance period.

Endowment insurance: The condition of co-insurance is that the insured dies during the insurance period and the insured still survives when the insurance expires.

In Taiwan, the death claim in personal life insurance is based on total disability (deemed dead) or death. As the saying goes, "The insurance company will not pay until you die." As a result, the public has a great rejection of insurance. and misunderstanding, and even feel that it is unlucky and unlucky, so they stay away from them and are unwilling to understand further.

A few years ago, I was invited by the dean of the Department of Finance and Taxation at Jinri University to share "How Freshers in the Workplace Can Manage Financial and Insurance Planning" to graduating students. After the sharing, the director said sincerely in his summary: "I have never thought about the importance of insurance planning, but I only really understand it today. It especially reminds me of the past agricultural society in Taiwan, because of the red envelopes and white envelopes. Culture, when someone in the village gets married, gives birth to a child, builds a new house, gets sick or is hospitalized unexpectedly, or someone dies or even joins the army, everyone will give red envelopes or white envelopes to help accomplish major life events or overcome difficult times. Once upon a time, young children in Taiwan. Culturalization, family structure changes, relationships between people have become colder, and insurance planning has replaced the traditional red and white envelope culture..." This is the first time I heard such a discussion, and I think it is very true and consistent with the social type of Taiwan in the past. state.

The real meaning and value of life insurance is not because someone dies, but because someone needs money to continue living. Especially when a man in his prime has a wife and children, if he dies, his wife will have to live with the children despite the grief of losing her husband. It is not difficult to imagine the hardship of this wife. The Bible says: "You must divide it among seven people, or among eight people, because you do not know what calamity will befall the earth in the future." (Ecclesiastes 11:2) At this time, life insurance comes into play and becomes timely cash. , pay for various living expenses. Therefore, the beneficiaries of personal life insurance are not the insured himself, but mostly his family members.

At present, life insurance products of various insurance companies are very diversified, such as savings products, fixed annual withdrawals, single withdrawals upon maturity, compound interest rollover increases, interest rate changes or convertible into annuities, etc., which are also types of life insurance. category. This article focuses on death life insurance.

death life insurance

Death life insurance is life insurance based on total disability or death. Like medical insurance, it is divided into two types: term and lifetime. Term life insurance is guaranteed within a certain period of payment, such as 10 years, 15 years, 20 years, 25 years or 30 years. When the payment period is up, the contract is terminated and there is no longer life insurance protection. Whole life insurance refers to the payment period for a certain period, such as the agreed payment period of 10 years, 15 years, 20 years, 25 years or 30 years. When the payment period expires, there is no need to continue to pay premiums, and you have life insurance protection for life.

There are two types of people who need the most life insurance planning: one is those who have responsibilities; the other is those who need tax planning, especially inheritance tax planning (the current highest inheritance tax rate in Taiwan is 20%).

1. Persons with responsibilities

The Bible says: "Whoever does not look after his relatives has denied the faith and is worse than an unbeliever, especially if he does not look after his own household." (1 Timothy 5:8) When a person must bear the responsibility When your family needs it for daily life, you must plan life insurance. For example: married people who are responsible for the living and education expenses of their spouses and children; people who are responsible for taking care of their parents, minor siblings, or housing loans; entrepreneurs who have operational and management responsibilities for shareholders and employees, etc. In other words, if a person's death will have a significant impact on other people's basic daily life or business operations, life insurance planning is needed to avoid family life being in trouble or the business experiencing a business crisis when he leaves the world.

Another important point is the life insurance coverage amount. Everyone has different responsibilities, different lengths of responsibility, and different expenses they can afford, so they must be considered comprehensively together.

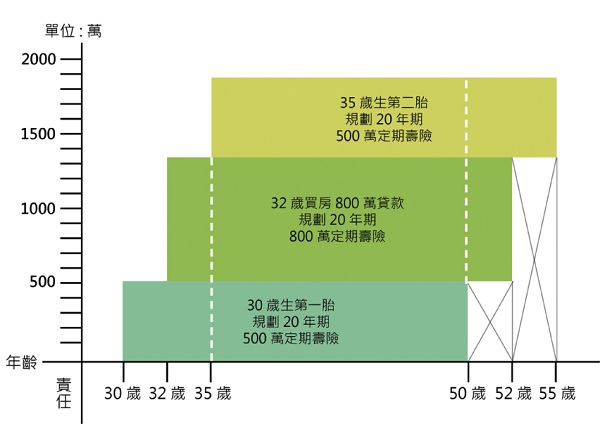

For example: a married man gave birth to his first child at the age of 30. Although it is said that having a child brings a sweet burden of 10 million yuan, let us plan based on the responsibility of 5 million yuan for a child.

From the birth of the child to the age of 20, the father must plan a 20-year term life insurance policy with an insured amount of 5 million yuan, with himself as the insured and the insured.

If you buy a house in your own name at the age of 32 and apply for a 20-year house loan of 8 million yuan from the bank, you must plan a 20-year term life insurance with an insured amount of 8 million yuan to cover the house loan. Risk is transferred to the insurance company.

If you have a second child at the age of 35, you must plan a 20-year term life insurance with an insurance limit of 5 million yuan.

The father's responsibilities continue to increase, and the liability risk is greatest between the ages of 35 and 50. Even so, income and expenses still need to be considered, the most appropriate amount of insurance is made within the budget, and the risk is transferred to the insurance company.

Tip: When applying for a home loan and fees from a bank, the bank often requires you to sign another mortgage policy when signing the contract. At this time, you should pay special attention. The beneficiary of such a policy is often the lending bank, although the bank will claim that when the lender dies, , the claim can be used to repay the entire mortgage loan at once. In fact, if an accident does occur, the beneficiaries should be family members. The family members can still pay the loan regularly, and the remaining compensation money can be used to handle affairs, pay for household expenses, children's education expenses, and continue to take care of the family, etc. The bank's argument may sound reasonable, but in fact it has lost the responsibility to take care of your family and the true meaning and value of life insurance planning.

2. Those who need tax planning

The Bible says: "A good man leaves an inheritance to his children; but sinners store up treasures for the righteous." (Proverbs 13:22) Currently in Taiwan, inheritance tax is levied when wealth accumulation exceeds a certain amount (the Internal Revenue Service will set a tax exemption limit every year, but Check the website of the Taiwan National Taxation Bureau), so those who need to pay inheritance tax can make an inventory based on their current situation, or go to the National Taxation Bureau to apply for the total transfer of personal assets. According to the current or future wealth accumulation situation, calculate the amount of inheritance tax and tailor-made personal assets. Life insurance planning, and designating beneficiaries, setting aside a sum of cash for property heirs to pay taxes. It is urgent for high-net-worth individuals to plan ahead.

Paragraph 9 of Article 16 of Taiwan’s Estate and Gift Tax Law stipulates: “When the deceased dies, the life insurance amount paid to the designated beneficiary shall not be included in the total estate.” This means that when the proposer and the insured are the same person, when the In the unfortunate event that the insured dies, the insurance money received by the beneficiary will be exempt from tax on the estate of the insured.

It is worth noting that the "life insurance amount paid to the designated beneficiary" mentioned in this law will not be included in the total estate. The main condition is that the proposer and the insured are the same person before it will not be included in the total estate (especially Note: the same declaring household is exempt from the restriction of including the estate if it is less than 33.3 million yuan). In addition, Taiwan also has restrictions on the minimum tax system, which will be discussed in depth in the future.

As we pursue wealth, hope for the best life for our beloved family, or strive to achieve our dreams, let’s not forget that the years of our lives are in God’s hands. The Bible says: “To everything there is a season, a time to be born and a time to die; a time to plant and a time to uproot what is planted.” (Ecclesiastes 3:1-2) It also says: “Man has an evil eye. He who wants to get rich quickly does not know that poverty will surely come to him.” (Proverbs 28:22) May God help us to use and allocate money wisely, and through correct financial and insurance planning, in addition to fulfilling the love commitment to our family. , and become a blessing to many people.

Pan Huating, general manager of Gabriel International Wealth Management Consulting Co., Ltd., founder of Gabriel Saint Financial Team, CEO of Taiwan Aetna Insurance Brokers Company, holds international financial planner and psychological counselor certificates, and is a member of the Chinese Boaz Association Teacher at Joshua School of Management. He loves life and devotes himself wholeheartedly to domestic and foreign gospel ministries, serving the disadvantaged in rural areas and poverty alleviation projects. He also participates in the ministries of entrepreneurs achieving kingdom enterprises and the Great Commission, and using his life to influence lives.

Pan Huating, general manager of Gabriel International Wealth Management Consulting Co., Ltd., founder of Gabriel Saint Financial Team, CEO of Taiwan Aetna Insurance Brokers Company, holds international financial planner and psychological counselor certificates, and is a member of the Chinese Boaz Association Teacher at Joshua School of Management. He loves life and devotes himself wholeheartedly to domestic and foreign gospel ministries, serving the disadvantaged in rural areas and poverty alleviation projects. He also participates in the ministries of entrepreneurs achieving kingdom enterprises and the Great Commission, and using his life to influence lives.